Success! We just sent you an email with a link to download your book.

JOIN US!

No Cost Online

Tax Efficient in Retirement Class

Tuesday or Thursday

at either 11:30 am or 6:30 pm

What We Will Cover During The Class:

What We Will Cover During The Class:

How to Achieve the "Zero" Tax Bracket:

Strategies to eliminate unnecessary taxes

Tax-Efficient Income: How to structure retirement withdrawals for less tax impact

Optimize Social Security: Avoid costly mistakes on Social Security Benefits

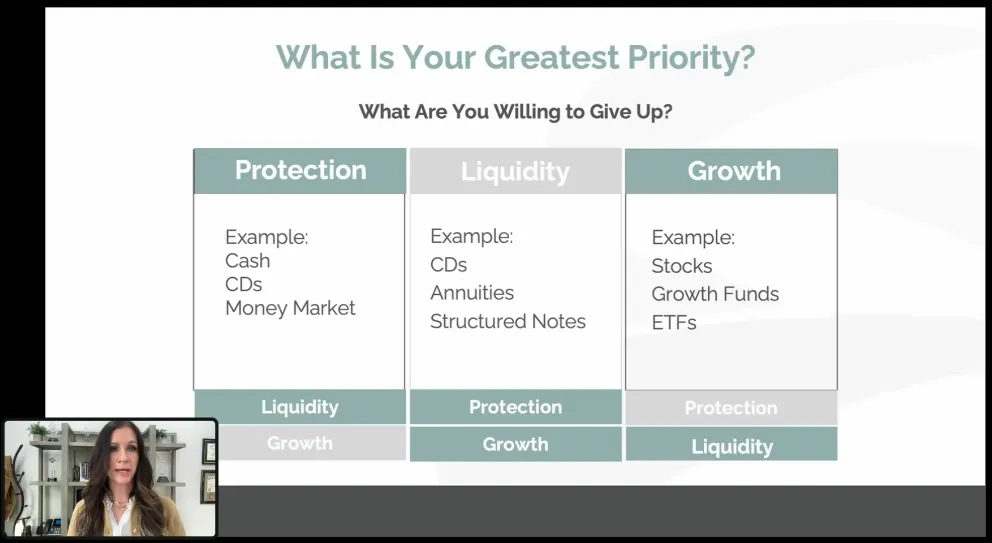

Smart Investment Strategies: Aligning portfolios to support tax goals

Real-Life Case Studies: See how others achieved greater tax efficiency in retirement

Discover smart strategies to reduce taxes and maximize your retirement income.

Do you worry about how taxes could impact your retirement savings? Our Tax Efficient in Retirement webinar shows you how to protect more of what you’ve saved and set up a lasting tax strategy. Learn proven techniques to reach the ‘zero-tax’ bracket, optimize Social Security, and make tax-efficient investment choices.

Maximize Your Retirement Savings

Learn actionable strategies to reduce tax burdens and keep more of what you’ve saved for retirement.

Avoid Common Tax Pitfalls

Understand key tax mistakes and how to avoid them, especially with Social Security and investment withdrawals.

Get Expert Insights & Real-World Examples

See real-life case studies that demonstrate how others have achieved tax efficiency and secured a more stable retirement.

This Class is for you if...

- You are concerned about running out of money in retirement and you need strategies that can provide predictable and reliable income streams

- You want to maintain a similar or better lifestyle in retirement and are looking for ideas on how to do that with the assets you have

- You want to make sure your loved ones have appropriate insurance coverage that can help them manage the unexpected

- You care about being strategic with you money and making plans that are tax-efficient

Bonus:

Complimentary Retirement Kit

Register for the class and get the entire Tax-Free Retirement Kit for no cost!

Frequently Asked Questions

Q: How long is the webinar?

A: The Tax Efficient in Retirement webinar is just under an hour. We’ve packed it with essential strategies to help you plan for a tax-efficient retirement, while keeping it concise and valuable.

Q: Is there a cost to attend?

A: No, this webinar is completely free! There’s no cost or obligation to attend – just a unique opportunity to learn more about managing taxes in retirement.

Q: Do I need any special equipment to join?

A: You can watch the webinar from your phone, but for the best experience, we recommend tuning in on a laptop or desktop.

Q: What happens after I register?

A: After you register, you’ll receive a confirmation email with all the details you need to join. We’ll also send a reminder closer to the webinar date, so you don’t miss out!

Q: Will I have a chance to ask questions?

A: Yes! There will be a chat box for questions, as well as the chance to talk to someone one-on-one.

©2025. All rights reserved.

Hosted by Jennifer Landon, an Investment Advisor Representative for Journey Financial Services.

This course is held all around the country but is not affiliated with any of these locations.